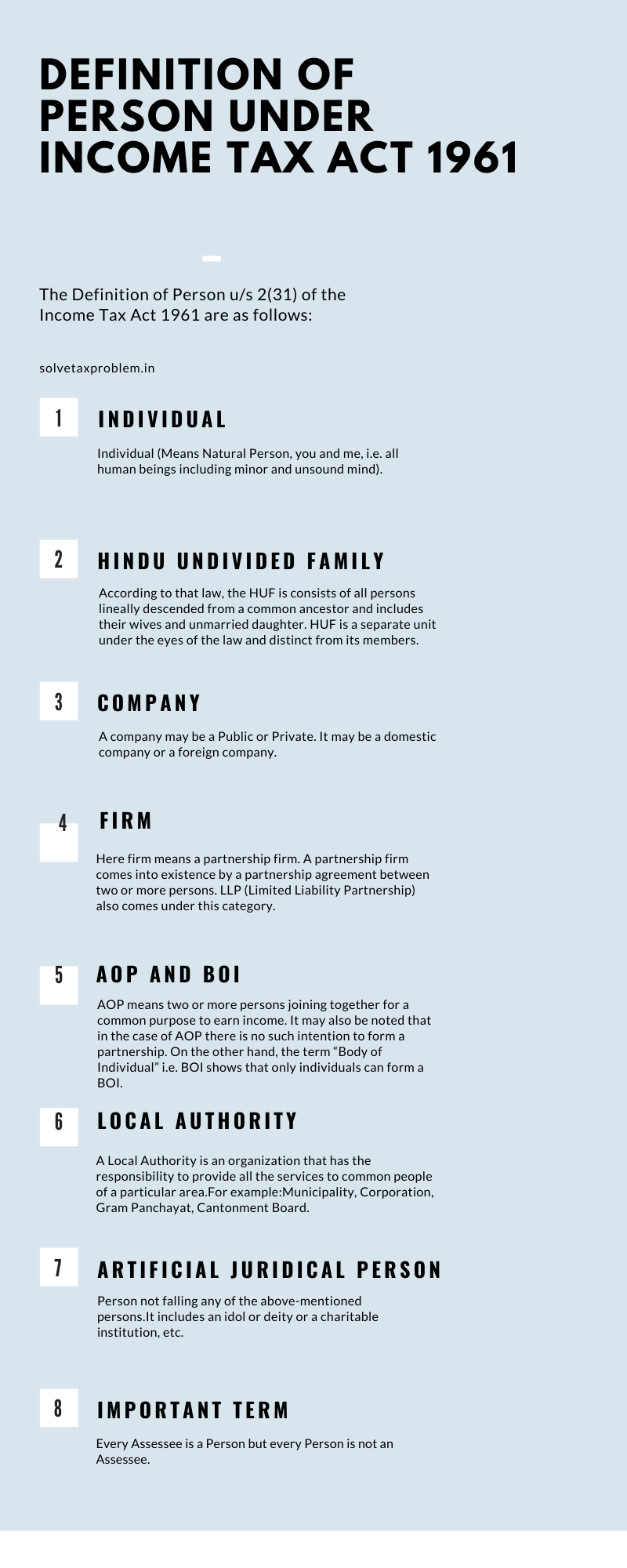

Who is a 'Person' under S. 2(31) of Income Tax Act in India

Find out what constitutes a 'person' under Section 2(31) of the Income Tax Act in India and what it means for tax purposes.

Benefits of Filing Income Tax Returns(ITR): 6 Key Points

Definitions in Income Tax Act 1961 with MCQs - Deep Gyan®

Income Tax Budget 2024 Highlights: Modi Govt gives no relief to middle-class taxpayers. Details of slabs, regimes here

Income tax in India - Wikipedia

Definitions in Income Tax Act 1961 with MCQs - Deep Gyan®

Defination of Persons Under Income Tax Act, 1961

Income under Section 2(24) of Income Tax Act, 1961

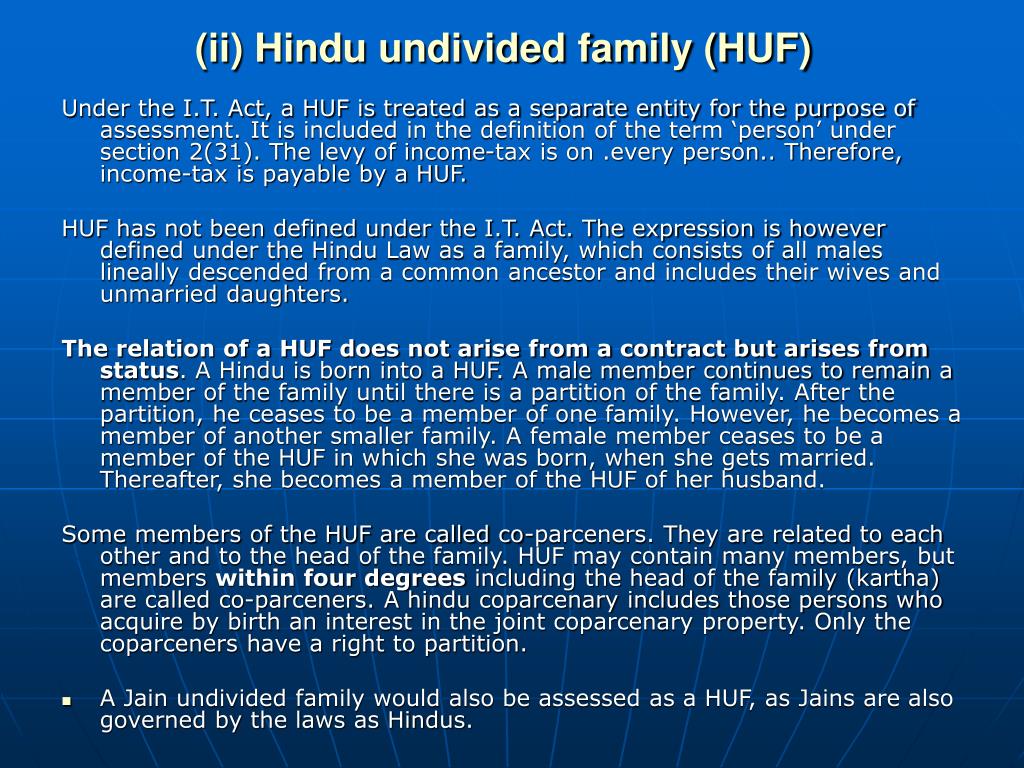

PERSON Section 2(31) of the Income Tax Act 1961. Basic concept of Income tax

PPT - IMPORTANT DEFINITIONS IN THE INCOME-TAX ACT, 1961 PowerPoint Presentation - ID:1059883

Income Tax on Online Gaming in India Detailing Provisions for Taxation and TDS on Winnings

Person under income tax act, 1961

Section 115bb - Betting Exchange India

New Clause (H) of Section 43B with Applicable Date & Effect

Definition of Person under the Income Tax Act 1961

:max_bytes(150000):strip_icc()/over-under-bet-5217714-final-f0d4aa1f59b6473fb0f070da81a8f8cb.png)